Complaints Management Policy

Introduction

- Exance Services Ltd specialises in provisions of structural defect warranties to the construction industry and as such we have certain specific duties towards our valued Developers and Buyers. One of these duties is the establishment of a formal Complaints Management Framework, which will enable the Developer and/or the Buyer to exercise their rights as provided for in the Financial Conduct Authority Act (FCA), as well as all other applicable laws to lodge a Complaint (as defined) against any of Checkmate’s service levels or alike whilst performing the applicable financial services.

Definitions

Adjudication | The process by which and Adjudicator reviews evidence and statements set forth by opposing parties in a Checkmate’s Dispute Resolution Scheme (DRS) process. |

Adjudicator | The Adjudicator acts as a fair and unbiased referee who assesses Complaints within the Checkmate Dispute Resolution Scheme (DRS). |

Advice | A recommendation or opinion given by an adviser that suggests or influences a course of action. |

Checkmate | Checkmate is a trading name of Exance Services Limited. Registered in the United Kingdom with Companies House under registration number 03366581, with registered address: Suite 70 179 Whiteladies Road, Clifton, Bristol, England, BS8 2AG. Exance Services Limited are authorised and regulated by the Financial Conduct Authority, registration number 300804. |

Checkmate Dispute Resolution Scheme (DRS) | A procedure for dealing with a Dispute between the Buyer and the Developer where: (i) it has not been possible for this Dispute to be Resolved informally; and (ii) this Dispute is outside of the scope of the Checkmate structural defect policy. |

Buyer(s) | Any person, social landlord, corporate body, partnership, or Limited Company who reserves or buys a new or newly converted home from the Developer. |

Complaint | An expression of dissatisfaction (oral or written), whether justified or not, from, or on behalf of, a person about the provision of, or failure to provide, a financial service or redress determination. It alleges how you have suffered (or may suffer): financial loss; material distress; or material inconvenience. |

Complainant | A person on whom the legal right to benefit from a claim against the respondent under a contract of insurance has been devolved by contract, assignment, subrogation, or legislation. |

Complaints Handling | The process of attending to and resolving Complaints including ongoing interaction with Complainants. The Complaints handler is adequately trained, they have an appropriate mix of experience, knowledge, and skills in TCF Complaints Handling. |

Complaints Management System | The set of electronic applications and related case management software used by Checkmate for recording, classifying, routing, escalating, and resolving individual Complaints received by the business. In relation to the Complaints management function as a whole the system is used by the business to monitor, analyse and report on Checkmate’s performance in relation to Complaints management. |

Developer | A person, sole trader, partnership, company, or other organisation that constructs new, or newly converted homes under contract and is a registered member of the Checkmate scheme and bound to adhere to the Checkmate Consumer Code for New Homes. |

Dispute | A written Complaint made by the Buyer of the home to the Developer, as a result of the Developer failing to comply with the requirements of the code. The Buyer must make the Complaint, within 2 (two) years of the date of practical completion. |

Evidence | The information Checkmate has obtained in order to review, adjudicate and resolve a Complaint and shall include all information submitted by an entity as well as from the Complainant and shall be stored and recorded on the Complaints Management System or other repositories for storing and recording information. |

Financial Conduct Authority (FCA) | The Financial Conduct Authority who regulates the Financial Services industry within the UK. |

General Data Protection Regulation (GDPR) | The protection of natural persons regarding the processing of personal data and on the free movement of such data. |

Redress Determination | A written communication from a respondent under a consumer redress scheme which: (i) sets out the results of the respondent’s determination under the scheme; (ii) encloses a copy of The Property Ombudsman Service’s standard explanatory leaflet; and (iii) informs the Complainant that if he/she is dissatisfied, he/she may now make a Complaint to The Property Ombudsman Service and must do so within 6 (six) months. |

Rejected | A Complaint that has not been Upheld and Checkmate regards the Complaint as finalised after advising the Complainant that it does not intend to take any further action to resolve the Complaint and includes Complaints regarded by the provider as unjustified or invalid, or where the Complainant does not accept or respond to Checkmate’s proposals to resolve the Complaint. |

Reports or Reporting | Any periodic or ad-hoc Reporting (and related documents) obtained from the Complaints Management System and other sources in the business which shall be used for analysis, monitoring, submissions to regulatory authorities, and the making of recommendations to the business. |

Reportable Complaint | Any Complaint other than a Complaint that has been: (i) Upheld immediately by the person who initially received the Complaint; (ii) Upheld within Checkmate’s ordinary processes for handling Developers or Buyers queries in relation to the type of financial product or financial service complained about, provided that such process does not take more than five business days from the date the Complaint was received; or (iii) Submitted to or brought to the attention of Checkmate in such a manner that Checkmate does not have a reasonable opportunity to record such details of the Complaint as may be prescribed in relation to Reportable Complaints. |

Resolved | A Complaint is Resolved where the Complainant has indicated acceptance of a response from the Respondent, with neither the response nor acceptance having to be in writing. |

The Financial Ombudsman Service (FOS) | A free and official service that settles Complaints between consumers and financial businesses in the UK. |

The Property Ombudsman (TPO) | The Property Ombudsman scheme provides consumers and property agents with an alternative Dispute resolution scheme. |

Treating Customers Fairly | An outcomes based regulatory and supervisory approach designed to ensure that regulated financial institutions deliver specific, clearly set out fairness outcomes for financial customers. Regulated entities are expected to demonstrate that they deliver the following 6 (six) TCF outcomes to their customers throughout the product life cycle, from product design and promotion, through Advice and servicing, to Complaints and claims handling. |

Upheld/Not Reportable | A Complaint has been finalised wholly or partially in favour of the Complainant and that: (i) The Complainant has explicitly accepted the matter is fully Resolved; or (ii) It is reasonable for Checkmate to assume that the Complainant has so accepted; and (iii) All undertakings made by Checkmate to resolve the Complaint have been met or the Complainant has explicitly indicated its satisfaction with any arrangements to ensure such undertakings will be met by Checkmate within a time acceptable to the Complainant. |

Purpose of a Complaints Policy

- The purpose of this document is to inform our Developers and Buyers of the procedure which will be followed to provide a resolution for a Compliant submitted to Checkmate.

- In terms of the Financial Conduct Authority, Checkmate must establish, maintain, and operate an adequate and effective Complaints Management Framework, to ensure the effective resolution of Complaints and the fair treatment of Complainants.

- The Complaints Management Framework must be based on the following outcomes:

- Is proportionate to the nature, scale and complexity of Checkmate’s business and risks;

- Is appropriate for the business model, policies, services, Developers and Buyers of Checkmate;

- Enables Complaints to be considered after taking reasonable steps to gather and investigate all relevant and appropriate information and circumstances, with due regard to the fair treatment of Complainants;

- Does not impose unreasonable barriers to Complainants.

- In order to achieve the abovementioned outcomes, Checkmate has adopted a Complaints policy which outlines Checkmate’s commitment towards the fair, transparent and effective resolution of Complaints in line with all applicable laws. Checkmate also ensure that the Complaints Management Framework is regularly reviewed (at least annually) to ensure the effectiveness of same.

Allocation of Responsibilities

- The internal Complaint review and escalation process may be delegated to the compliance officer, and any queries relating to the process must be directed to same.

- Please see Checkmate’s compliance officer details to submit a Complaint – Shana Aleixo: complaints@checkmate-warranty.co.uk

Responsible and Adequate Decision-making

- Any person in Checkmate that is responsible for making decisions or recommendations in respect of Complaints generally, or a specific Complaint must:

- Be adequately trained;

- Have an appropriate mix of experience, knowledge and skills in Complaints Handling, fair treatment of customers, the subject matter of the Complaints concerned and relevant legal and regulatory matters;

- Not be subject to a conflict of interest; and

- Be adequately impowered to make impartial decisions or recommendations.

Categories of Complaints

- Checkmate categorises Reportable Complaints in accordance with the following 9 (nine) categories:

Design

Product and services sold to you did not meet your needs.

Information Provided

You were not provided with information that was clear or easy to understand.

Advice

You were not provided with suitable and correct Advice.

Performance

The policy did not perform as per your understanding.

Service

You did not receive good or sufficient service from us.

Accessibility

You found it difficult to communicate with us.

Complaints Handling

You found it difficult when lodging a Complaint.

Claims Handling

You were not kept updated with your dealings with us, when lodging a claim, you were not satisfied with the outcome, you found it difficult to communicate with us.

- Should Checkmate consider adding additional categories relevant to its financial products, financial services and/or Developer base, it will do so to support the effectiveness of Checkmate’s Complaints Management Framework, and by doing so enhancing improved outcomes and processes for our Developers and Buyers. Checkmate will categorise, record and report on Reportable Complaints by identifying the category of Complaint to which the Complaint most closely relate and group Complaints accordingly.

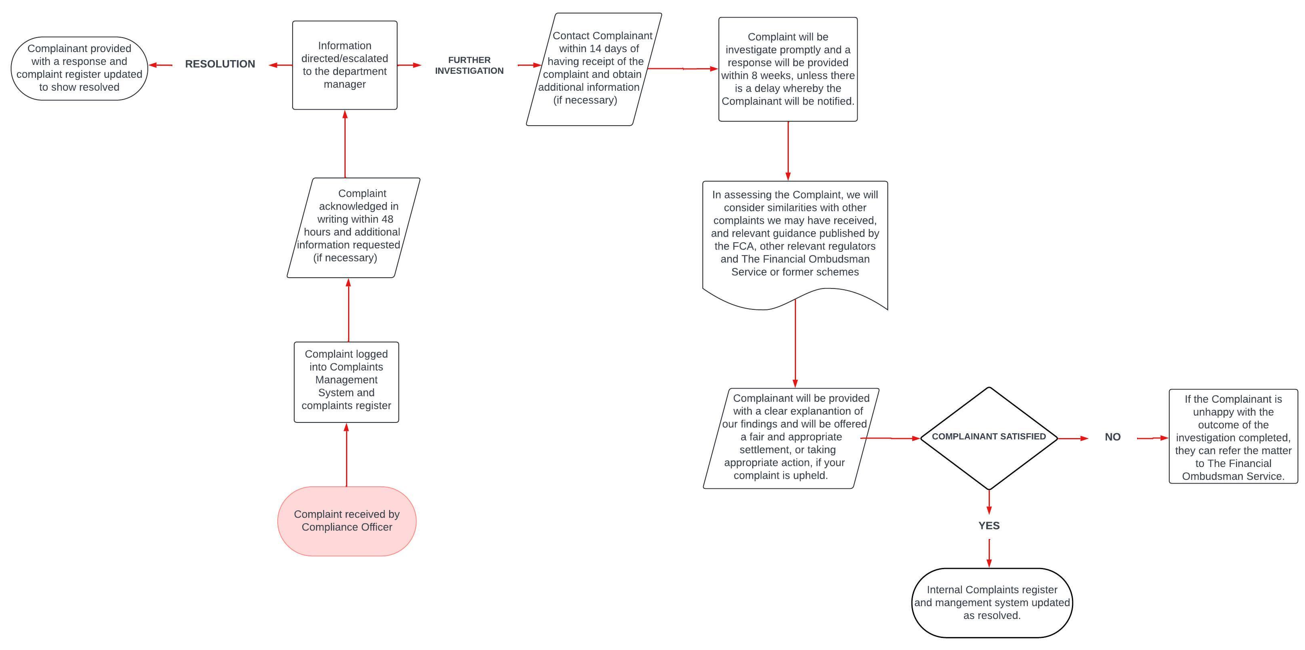

Internal Complaint Escalation and Review Process

- Checkmate is committed to ensuring that the procedures within the Complaints escalation and review process is not overly complicated and does not impose unduly burdensome paperwork or other administrative requirements on Complainants.

- The internal Complaints escalation and review process:

- Follows a balanced approach, which bears in mind the legitimate interests of all parties involved, including the fair treatment of Complainants;

- Provides for the internal escalation of complex or unusual Complaints at the request of the initial Complaint handler;

- Provides for Complainants to escalate Complaints not Resolved to their satisfaction.

- Checkmate’s internal Complaints resolution process is intended to provide for the fair and effective resolution of Complaints. The time periods set in this procedure will be adhered to as strictly as possible but may be varied if necessary. The following step by step guideline sets out the procedures we will adopt and demonstrates how a Complaint will be dealt with, once received by us:

- Furnish the Complainant with a copy of the Complaints Management Framework procedure;

- Where the Complainant has previously communicated the grievance verbally, instruct the Complainant to resubmit the Complaint in writing and confirmation of the Complaint will be confirmed in writing within 48 (forty-eight) hours of the communication;

- Please indicate the following information:

- Name, surname and contact details;

- A complete description of your Complaint and the date which led to your Complaint.

- All Complaints received via any means of communication is forwarded to complaints@checkmate-warranty.co.uk and the Complaint will be entered into our Complaint register on the same day that it is made, and written confirmation of receipt will be forwarded within 48 (forty-eight) hours of having received the Complaint by the designated Complaints handler by way of email; telephonically or on a social media platform.

- Complaints are acknowledged by Checkmate’s compliance officer within 48 (forty–eight) hours of receiving notification of the Complaint, and further response and information is to be addressed to complaints@checkmate-warranty.co.uk

- If a Complaint is ‘Not Reportable’ or ‘Upheld’:

- The Complaint is directed to the compliance officer of Checkmate;

- Information regarding the Complaint is directed and escalated to the relevant department manager;

- Where the matter is capable of being Resolved the Complainant is contacted within 48 (forty-eight) hours and a formal response that the matter is Resolved is sent to the Complainant. The relevant update will be done on the system;

- Where there is more information required, the Complainant will be contacted within 14 (fourteen) days of having receipt of the Complaint with formal response and advise of the reasons thereof;

- In this instance, 8 (eight) weeks is allowed to provide formal feedback regarding the Complaint. The relevant updates will be done on the system and the file will be closed as Resolved;

- We will keep record of the Complaint and maintain such records for 5 (five) years as required by legislation.

- Where the matter is a ‘Reportable Complaint’:

- The Complaint will be directed to the compliance officer at complaints@checkmate-warranty.co.uk

- The Complaint will be logged onto the Complaints Management System and internal Complaints register;

- The Complaint will be acknowledged in writing within 48 (forty-eight) hours and confirmed with a formal response via email or directly on the social media platform;

- Where there is more information or further investigation required, contact with the Complainant will be within 14 (fourteen) days of having receipt of the Complaint with formal response and advise of the reasons thereof;

- The Complaint will be investigated promptly, and a response will be provided within 8 (eight) weeks, unless there is a delay whereby the Complainant will be notified;

- In assessing the Complaint, we will consider similarities with other Complaints we may have received, and relevant guidance published by the FCA, other relevant regulators and The Financial Ombudsman Service or former schemes.

- The Complainant will be provided with a clear explanation of our findings and will be offered a fair and appropriate settlement, or appropriate action will be taken if your Complaint is Upheld.

- Where the Complainant is satisfied with the outcome our internal Complaints register will be updated with ‘Resolved’ and our file closed as well as the Complaints Management System updated, and matter Resolved and closed.

- Should the Complainant still not be satisfied with the outcome you may inform the Complainant of his/her right to escalate the matter to The Financial Ombudsman within 6 (six) months from the date on the final response from Checkmate.

- In this instance, we will close our file on our side and same will be updated on the Complaints Management System and our central Complaints register, until and/or if we receive notification from the office of the Ombudsman of a claim being logged with the above office, we will proceed to log a new Complaint on our internal TPOS Complaint register.

Engagement With the Property Ombudsman Service

- Checkmate is committed to transparent engagement with any relevant Ombud in relation to its Complaints.

- The Property Ombudsman (TPO) is a not-for-profit independent company that provides free, impartial, and independent Ombudsman service, resolving Disputes between Consumers and Property Agents.

- The Ombudsman is not a regulator and does not have the authority to take legal or regulatory action against an agent, impose fines or dictate the way agents conduct their business.

- The Property Ombudsman (TPO):

Physical Address: Milford House, 43-55 Milford Street, Salisbury, Wiltshire, SP12BP Telephone: 01722 333306

Website Address: https://www.tpos.co.uk/

Email Address: admin@tpos.co.uk

Engagement With the Financial Ombudsman Service

- The Financial Ombudsman Services is a free and easy-to-use service that settles Complaints between consumers and businesses that provide financial services.

- The Financial Ombudsman Services (FOS):

Physical Address: Exchange Tower, London, E14 9SR

Telephone: 0800 023 4567

Website Address: Financial Ombudsman Service: our homepage (financial-ombudsman.org.uk)

Email Address: complaint.info@financial-ombudsman.org.uk

Record Keeping, Monitoring and Analysis

- Records of all Complaints and responses are maintained on Checkmate’s Complaints Management System for a minimum of 5 (five) years until finalisation of the matter. We are TCF (Treating Customers Fairly) driven and one of the responsibilities of our TCF Committee to monitor and analyse trends and patterns of Complaints that may be reported to and addressed by our Executive Committee.

Annexure A: Checkmate Complaint Process